Some Of What Is Trade Credit Insurance

Some Known Factual Statements About What Is Trade Credit Insurance

Table of ContentsWhat Is Trade Credit Insurance - An OverviewEverything about What Is Trade Credit InsuranceGet This Report about What Is Trade Credit Insurance

After that, throughout the year, if any of those buyers fold or do not pay, then we will make the settlement. We check out the entire turnover of a business and we finance the whole. "What we're seeing through electronic platforms is that people can go on the internet as well as can sell a solitary invoice.

What the customer can after that do is take the choice to insure that solitary invoice. "At Euler Hermes, we think there's going to be a shift in the method profession credit report insurance is dispersed.

The Definitive Guide for What Is Trade Credit Insurance

Need a broker? See our overview to discovering the appropriate broker.

For instance, a manufacturer with a margin of 4% that experiences a non-payment of 50,000 would need 25 comparable sales to make up for a single instance of non-payment. Credit top article insurance mitigates against this loss. You can cut spending on credit scores information as that's covered, and also you won't need to waste resources on going after collections.

You might have the ability to discuss beneficial terms with your vendors as a credit insurance plan minimizes the effect of a poor debt on them and possibly the entire supply chain. Debt insurance policy is there to help you protect against and also alleviate your trading risks, so you can develop your organization with the understanding that your accounts are safeguarded.

A business desired to broaden sales with its current consumers however was not completely comfy providing them greater debt limitations. They got in touch with Coface credit rating insurance policy to cover the higher credit rating restrictions so they might raise the amount of credit rating used to customers without threat - What is trade credit insurance. This let them expand revenues as well as supply more earnings.

Getting My What Is Trade Credit Insurance To Work

"From the preliminary goal of giving comfort to our banks, the service go to website added deepness to our organization choices." The interaction enabled the business to analyze its clients' condition a lot more properly and also has been an important device in organization development.

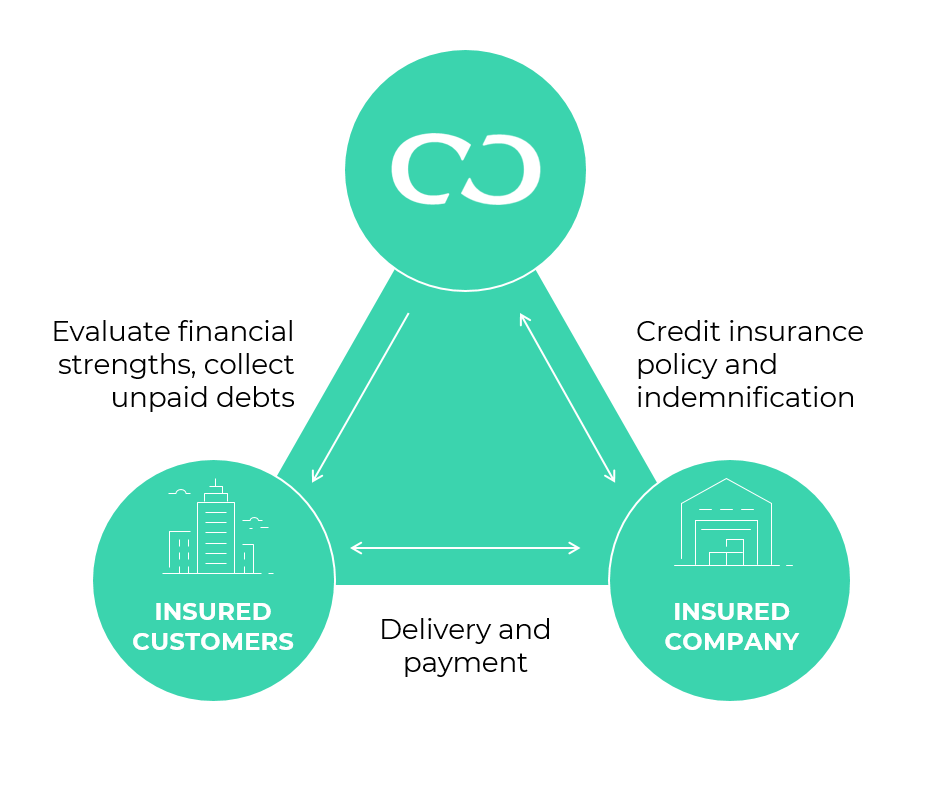

Australian services owe around $950 billion to various other organizations. Which suggests it's important to have protections in position to ensure that in the event a lender does not satisfy its responsibilities, business can still redeem its cash. Securing profession credit scores insurance coverage is one means you can site here do this. Profession credit insurance policy provides cover when a customer either comes to be bankrupt or does not pay its financial debts after a particular duration (which is set out in the insurance plan).

"In the event a debt is overdue, the policy owner may be able to assert as much as 90 percent of the quantity of that debt, thinking about any type of excesses that might be appropriate," he includes. When it pertains to collecting the financial debt, typically the insurance provider will certainly have its own financial debt debt collector and also will seek the financial obligation in behalf of business.